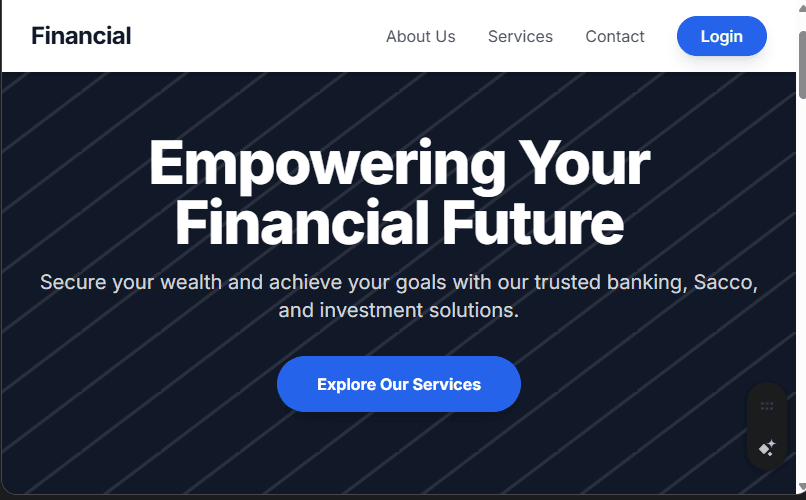

Financial Services Website Design (Banks, Saccos, Investment Firms) in Kenya

-

Delivery Time2 Weeks

-

English levelProfessional

-

LocationUSA, United Kingdom, United Arab Emirates, Nairobi, Langata Nairobi, Kenya, France, Dubai, CBD Nairobi, Canada, Australia

Service Description

The cost of a Financial Services Website Design (Banks, Saccos, Investment Firms) in Kenya is 80,000 KES. Get a Financial Services Website Design (Banks, Saccos, Investment Firms) at Black Shepherd Technologies for 70,000 KES NOW!!.

Specialized website design services for Kenyan banks, SACCOs, and investment firms. We create secure, intuitive, and mobile-first digital platforms that build trust, enhance customer engagement, and drive business growth in Kenya’s evolving financial market.

In Kenya’s vibrant and competitive financial landscape, a modern, secure, and user-friendly website is the cornerstone of any successful institution’s digital strategy. For commercial banks, member-driven SACCOs, and dynamic investment firms, the website serves as the primary digital touchpoint—a powerful tool for building trust, providing seamless access to services, and connecting with a diverse clientele. This comprehensive guide outlines the key considerations, best practices, and essential features for designing a high-impact financial services website tailored specifically for the Kenyan market.

The era of static, brochure-style websites is over. Today’s Kenyan customers, empowered by high mobile penetration and the rapid growth of FinTech, expect a fluid, interactive, and personalized digital experience. A well-designed website acts as a digital branch, accessible 24/7, where customers can manage their finances, apply for credit, and learn about new products. The challenge lies in creating a platform that is not only visually appealing but also technically robust, highly secure, and compliant with local financial regulations.

Pillar 1: Building Trust and Prioritizing Security

Trust is the bedrock of any financial relationship. Your website must be a bastion of security and transparency. The design should immediately convey a sense of reliability. This is achieved through a combination of visual and functional elements:

Robust Cybersecurity: Implement and prominently display security certifications such as SSL encryption to reassure users that their data is protected. Use clear, simple language to explain your data protection policies and commitment to privacy, building a foundation of trust.

Regulatory Compliance: Showcase logos and affiliations with key regulatory bodies like the Central Bank of Kenya (CBK) and the SACCO Societies Regulatory Authority (SASRA). This signals that your institution operates with accountability and integrity.

Transparent Communication: Use clear and honest language in all content, from product descriptions to terms and conditions. Avoid jargon and ambiguity. Customer testimonials, case studies, and a visible leadership team can further humanize the brand and foster a sense of genuine connection.

Pillar 2: The Mobile-First and Responsive Design Imperative

Given that the majority of internet access in Kenya is via mobile devices, a mobile-first website design is non-negotiable. Our approach involves designing for the smallest screens first, ensuring that all functionality is accessible and intuitive on smartphones and tablets.

Fluid Layouts: The design must use flexible grids and layouts that automatically adjust to any screen size, preventing horizontal scrolling and ensuring content is always legible.

Touch-Friendly Interface: All interactive elements, including buttons, menus, and form fields, must be large enough to be easily tapped with a finger.

Performance Optimization: Websites must load quickly, even on slower mobile networks. We achieve this by optimizing images, minimizing code, and leveraging efficient front-end technologies. A fast-loading, responsive site provides a superior user experience (UX) and enhances brand perception.

Pillar 3: A Tailored Content Strategy for Your Institution

A generic financial website will not stand out. The content must be strategically aligned with the unique services and target audience of your institution.

For Banks: A bank’s website should project a professional, modern image. Key content areas will include:

Personal Banking: Dedicated pages for savings accounts, current accounts, personal loans, mortgages, and credit cards.

Business Banking: Solutions for SMEs and large corporations, including business loans, corporate accounts, trade finance, and payroll services.

Digital Banking: A prominent section highlighting the convenience and features of your mobile banking app, internet banking portal, and USSD services, emphasizing digital transformation.

For SACCOs: A SACCO’s website should foster a sense of community and member empowerment. Content should focus on:

Membership Benefits: Clear information on how to join, the value of share capital, and the dividends members can earn.

Member-Focused Loans: Detailed descriptions of popular loan products like development loans, emergency loans, and school fees loans. Simple online calculators can help members understand their borrowing power.

Financial Inclusion: Content that speaks to the SACCO’s role in empowering its members and the community, often touching on microfinance and cooperative principles.

For Investment Firms: An investment firm’s website must project expertise and insight. Key content areas will include:

Investment Products: Comprehensive explanations of products like Unit Trusts, Treasury Bills & Bonds, and Pension Schemes.

Wealth Management: Information on personalized services for high-net-worth individuals and corporate clients.

Market Insights: A frequently updated blog or resource center with market analysis, economic outlooks, and educational articles to position the firm as a trusted thought leader in Kenyan investment.

Pillar 4: Essential Features and Functionality

To compete in the modern digital economy, your website needs to be more than just informational. It must be a dynamic, functional platform.

Secure Client Portal: A protected login area where customers can securely access their statements, check account balances, and perform transactions. This portal is the heart of any digital banking service.

Online Calculators: Highly engaging and practical tools for calculating loan repayments, savings growth, or mortgage affordability. These tools add immense value and keep users on the site longer.

Digital Forms: Streamline the customer journey by offering fully digital, secure, and user-friendly application forms for account opening, loan applications, and service requests. Progress bars and clear instructions can significantly improve conversion rates.

Interactive Chatbot & Live Chat: A 24/7 AI-powered chatbot can handle common queries, while a live chat feature allows customers to connect with a human agent for more complex issues, providing instant customer support and enhancing the overall user experience (UX).

Branch & ATM Locator: An integrated map-based locator helps users easily find the nearest physical branch or ATM, connecting the digital experience with the physical presence of your brand.

Financial Education Center: A repository of articles, videos, and infographics on topics like budgeting, saving, and investing. This positions your institution as a partner in your customers’ financial well-being.

In summary, the design and development of a financial services website in Kenya requires a strategic and holistic approach. By focusing on the core principles of trust and security, prioritizing mobile-first design, creating a tailored content strategy, and integrating essential functional features, your institution can build a powerful digital platform. This platform will not only meet the high expectations of today’s digital consumer but also serve as a key driver of growth, customer loyalty, and long-term success in Kenya’s competitive financial sector.